The Pros and Cons of Using Same-Day ACH Transactions for Faster Payments for Beginners

ACH ( ach payments ) purchases have ended up being a well-liked strategy for businesses to refine remittances. With the improvement of innovation, ACH transactions give a smooth and effective way for organizations to send and acquire funds digitally. In this post, we will check out the various styles of ACH deals that services can leverage to improve their repayment procedures.

1. Direct Deposit:

Straight deposit is one of the most popular types of ACH purchases utilized through services. It involves electronically placing funds directly in to an staff member's bank account, doing away with the need for newspaper checks. This not only conserves opportunity but also minimizes administrative costs connected along with publishing and distributing physical paydays. Direct deposit provides workers with fast get access to to their funds and makes certain well-timed settlement.

2. Supplier Repayments:

Companies may leverage ACH deals to produce provider repayments effectively. As an alternative of writing paper inspections or using typical cable transfers, businesses can initiate ACH settlements straight coming from their banking company accounts to providers' financial institution accounts. This eliminates the necessity for hand-operated processing and lessens the threat of errors connected along with paper-based settlements.

3. Payroll Processing:

ACH purchases are an exceptional answer for handling pay-roll properly and firmly. Businesses can utilize payroll software program included with their financial devices to initiate ACH moves, making certain well-timed remittance to employees' banking company accounts on payday. This simplifies the pay-roll method, decreases management trouble, and enhances accuracy in computing wages and deductions.

4. Persisting Billing:

For organizations that depend on reoccuring billing models such as membership companies or registration fees, ACH purchases provide a practical means to accumulate payments coming from customers on a normal basis. Through obtaining consumers' permission upfront, services may automate persisting invoicings with ACH transmissions, doing away with manual invoicing and decreasing overdue or missed remittances.

5. Online Purchases:

ACH purchases are progressively being used as an different settlement method for on the internet investments together with credit scores memory cards or digital pocketbooks like PayPal or Apple Pay. Through including ACH capabilities in to their e-commerce platforms, companies may use consumers the possibility to pay directly from their financial institution profiles. This supplies an additional repayment option and minimizes purchase expenses associated with credit scores memory card handling.

6. Loan Payments:

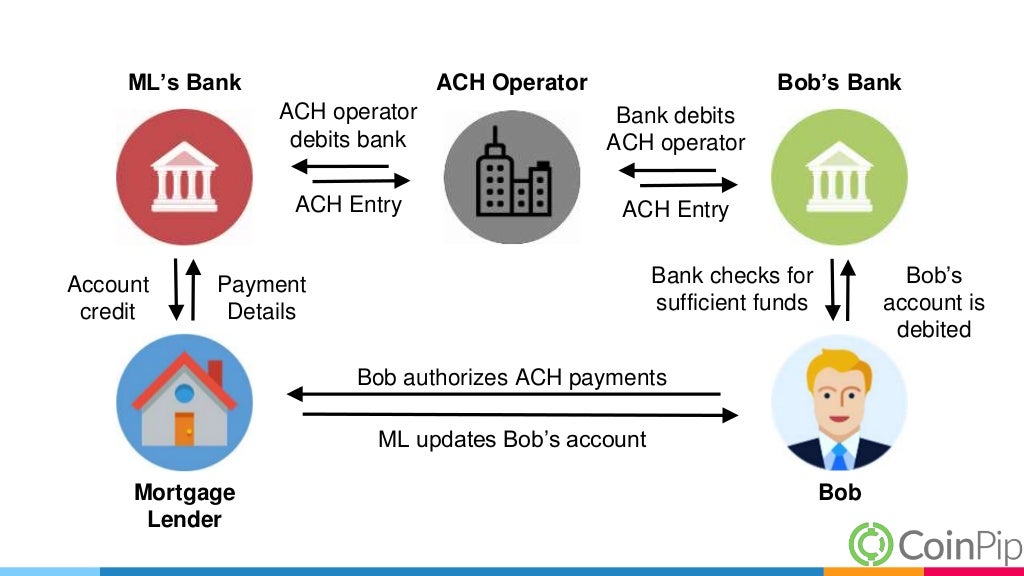

Economic institutions and lending business may leverage ACH deals for finance monthly payments. Debtors can authorize automated rebates coming from their banking company accounts, guaranteeing well-timed payment without the demand for manual check payments or check outs to bodily branches. ACH purchases simplify the loan settlement process, decrease late payments, and enhance general consumer total satisfaction.

7. Authorities Settlements:

Federal government organizations often make use of ACH transactions for helping make several styles of remittances, such as income tax refunds, social surveillance perks, or joblessness compensation. Through leveraging ACH capabilities, authorities can easily expedite remittance handling and minimize managerial price linked along with issuing newspaper checks or amount of money orders.

In verdict, services may leverage different types of ACH deals to simplify their payment processes and enrich effectiveness. From direct deposit for workers' salaries to internet purchases and provider settlements, ACH provides a safe and secure and handy procedure for electronic fund transfers. Through welcoming these several styles of ACH transactions, organizations may lower price, conserve time, lessen inaccuracies, and boost total cash circulation control. Taking advantage of technology-driven remedies like ACH purchases is essential in today's fast-paced business setting where digital transformation is key to excellence.